At a follow up meeting between the European Commission and the African Union at the11th Commission-to-Commission meeting in Brussels on 28 November, the EU reiterated its promise (originally announced at the EU-AU Summit in February 2023) to increase investment in African clean energy projects and to scale up infrastructure investment. It intends to do so through its EU-Africa component of the EU’s Global Gateway Investment Package. The package was launched in December 2021, and will likely channel much of the EU’s foreign aid budget up until 2027. It does so by aiming to “mobilise” up to €300 billion in investments, half of which will be for Africa (€150 billion). These figures include crowding in billions from the private sector although the balance between public and private sector contributions is unspecified.

The stated aims of the EU-Africa package are to support African countries in achieving a strong inclusive, green and digital recovery and transformation. The scope is wide and the investment plan is unclear, but it includes some loosely phrased targets such as increasing renewable energy and hydrogen by 300GW by 2030, and enhancing climate resilience and disaster risk response measures.

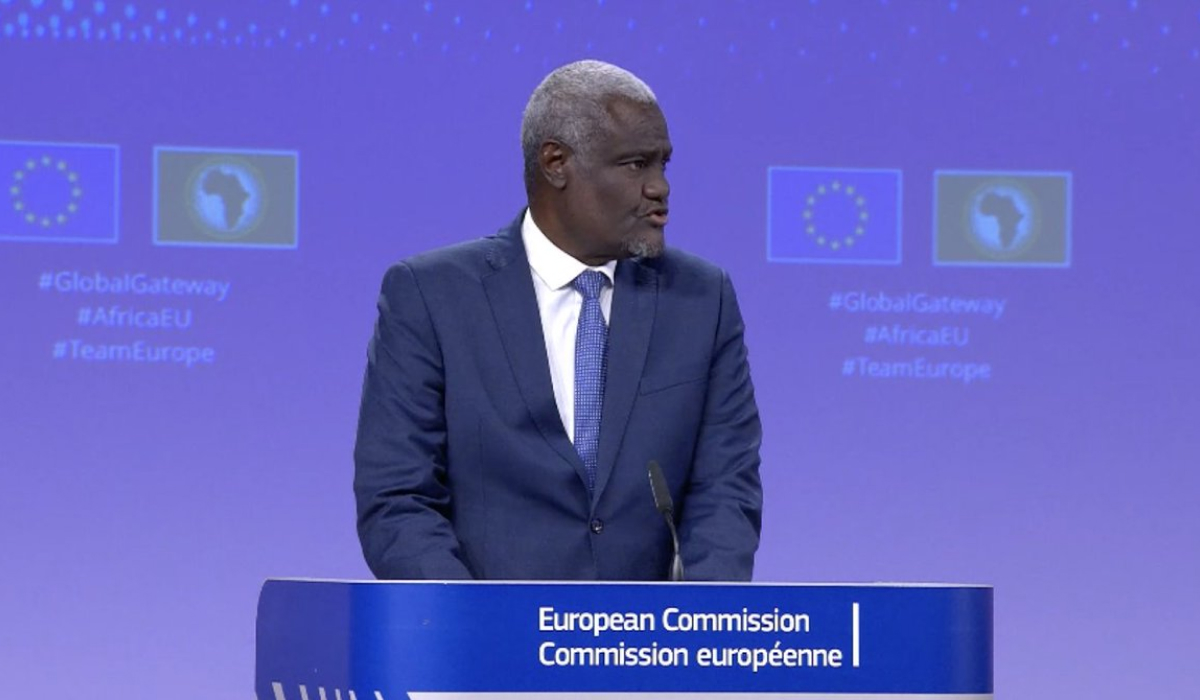

At the Commission-to-Commission meeting, concerns were raised by the African Union Commission Chairperson Moussa Faki Mahamat that “very often promises are not kept” when it comes to climate change. He did, welcome loss and damage developments at COP27, but reiterated that the ‘injustice” of past broken climate finance commitments “must be righted”.

The reference to past broken commitments relates to the 100 billion pledge under the UNFCCC from developed to developing countries, in respect of which there is still a material shortfall. Not only are there legitimate concerns that the finance of the Global Gateway might also not fully materialise, but that relying on the private sector to meaningfully contribute to the full delivery of the $300 billion (global) package, will encounter of the same challenges that befell the $100 billion UNFCCC pledge. Namely that (i) differing and unagreed accounting approaches to determining the amount provided and the role private sector finance led to different conclusions on the extent to which the target had actually been met; (ii) a lack of clarity on what volume of private sector investment was truly attributable to public sector initial investment; and (iii) an overestimation of how much the public sector can actively “crowd in” meant that reaching the target became precarious and ultimately led to shortfalls. Private sector finance was also provided on terms that were often low on concessionality or were not otherwise fit for purpose for African countries. In that context, clarity is needed on how much public sector finance will be provided under the Global Gateway.

There are also concerns about the double counting of ODA assistance. On additionality, Vince Chadwick has written that the funds are simply Neighbourhood, Development and International Cooperation Instrument (NDICI) money first proposed in 2018 (this is an €80 billion fund to support European external action between 2021 and 2027), and whatever Multilateral Development Banks, Development Finance Institutions and other EU member states elect to contribute, duly bolstered by private sector finance. He wrote that that the package only serves to “confuse everyone, waste time and distract everyone from the largely hidden dynamics on the boards of the major development banks”. Even the Member of the European Parliament for Dublin, Barry Andrews, has raised concerns that “It’s a strategy to put together what was already going to happen and present it as something new, and if our partners are tricked by this then more fool them”.

Lastly, greater specificity on what the funds will be applied to is also needed. Broad references to “scaling up disaster preparedness” and 300GW of “hydrogen” and renewables and “green transition” projects, need to be broken down into more concrete actions, particularly to determine the extent to which project design is truly recipient-country led. As Devex points out “it is not clear, including to staff charged with rolling out the scheme, what does and does not fit within the Global Gateway ‘framework’”.

Going forward to be meaningful and transparent, it will be important for the EU-Africa Global Gateway package to detail the sources of finance, the split between public and private finance, demonstrate how it is additional to existing finance, illustrate how the operationalized finance will overcome climate finance shortcomings and challenges raised by African countries, and provide a more detailed implementation plan for its roll out.